With COVID-19 continuing to disrupt normal business practices, companies and investors are searching for efficient ways to source, diligence, and close transactions remotely.

To meet this demand, Asoko Insight, a market intelligence and corporate data provider for Africa, is helping to shift discovery and diligence online for investors. The company has originated more than $850 million in deal opportunities in the past year and has built and run digital origination initiatives for private investors, stock exchanges, and governments, including the London Stock Exchange, African Development Bank, U.K. Department for International Trade, the U.S. International Development Finance Corporation, and the USAID West Africa Trade and Investment Hub.

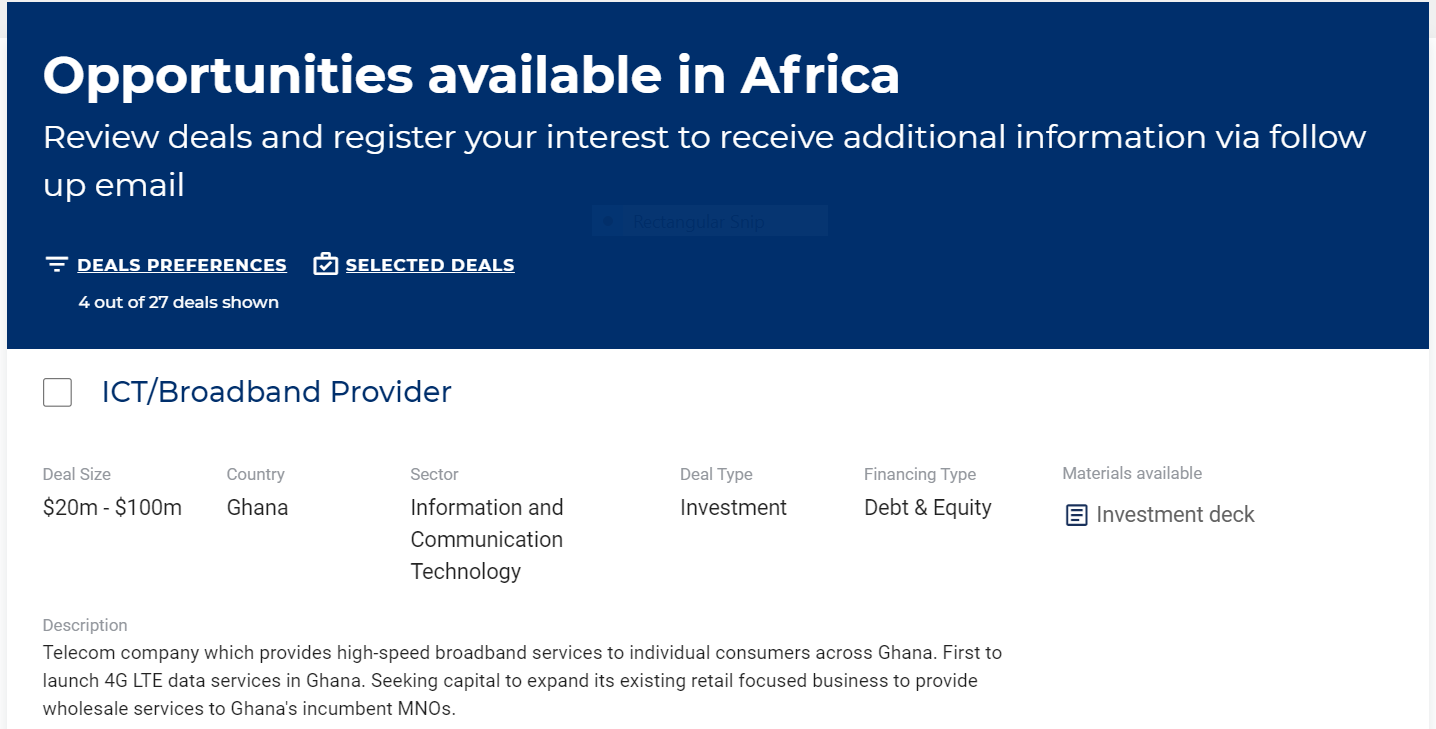

Asoko and its partner, CrossBoundary, are supporting Prosper Africa as it launches the Prosper Africa Virtual Deal Room to promote actionable trade and investment deals across Africa. The two firms are working closely with on-the-ground Prosper Africa Embassy Deal Teams to source and vet deals and make connections between businesses and investors. Through the virtual deal room, Prosper Africa will also help investors and trade counterparties gain access to U.S. Government support to mitigate risk, remove barriers, and move transactions to close.

Prosper Africa recently spoke with Greg Cohen, Chief Operating Officer and Co-Founder of Asoko Insight. He shared his thoughts on the impact of COVID-19 on the African investment landscape, the ways technology is changing investment, and how the Prosper Africa Virtual Deal Room can help investors find new opportunities.

This interview has been edited for clarity and length.

How has the investment landscape in Africa shifted since COVID-19 hit?

Greg Cohen: We’re starting to see private investors become more active again with their allocations, supported by good, overdue M&A headlines in the venture space. When COVID first started, there was an acute focus on portfolio management and putting out fires and a lack of allocation into new opportunities. Over the past few months, that has changed. We’re supporting research for a variety of new M&A opportunities investors are considering, and new deals are closing.

Overall, we’re seeing a trend toward everyday consumer and business transactions taking place digitally. The tech-enabled firms driving this trend across food, health, finance and logistics are growing quickly and are highly sought after by investors. Twiga, Kobo, mPharma, and Flutterwave are all good examples. Major deals that have closed during the pandemic are also highlighting the opportunities in African markets. The recent acquisition of PayStack by Stripe was a very notable liquidity event on the continent, for example. That deal received a lot of attention and shows the vibrancy of the fintech sector and the potential for growth, especially given all the demographic fundamentals that the continent has to offer.

How is technology changing the way investors are finding opportunities?

Cohen: There will be a permanent move towards some of the behaviors that we’ve adopted in response to the pandemic. We’ve all gotten used to tools like Zoom, Slack, and Docusign. These platforms have fundamentally changed the way we are doing business.

For investors and businesses, a good portion of the higher-value transactional and communication behaviors are going to stay online. This dynamic is very interesting for investors looking at emerging markets because a lot of traditional workflows require spending significant time on the ground. Our bet is that this workflow, and market information in general across Africa’s private sector, will move from analog to digital at a faster rate now. This will have a positive impact on the well-known challenges of risk perception and information asymmetry that plague investment in Africa. A lot of work needs to be done around investment readiness on the continent, but there are already quality deals that have been invisible to Western investors.

In response to COVID-19, we have really shifted our business model to digital engagement. Traditionally, we have been a data business focused on selling access to information that we’ve collected across the continent. But we have seen a significant change in demand for our services where investors or traders want immediate connection to the opportunity. They may not be able to fly to Ethiopia or Nigeria right now, so it’s really important that they can manage a remote pipeline, quickly understand if the deals are quality, and start their own due diligence cycle with more information and more open eyes.

What does the Prosper Africa Virtual Deal Room offer?

Cohen: First of all, it’s exciting to see the U.S. Government enable a private sector-led, digital marketplace for trade and investment opportunities in Africa. The Prosper Africa Virtual Deal room is a centralized portal that showcases quality deals that have been pre-verified and vetted. Users can manually browse or set up criteria to receive notifications when relevant deals come on the platform. By the time investors or traders get to the platform, we are ready to connect them directly to live, high-quality opportunities. The discovery work, in particular, will have a high value for U.S. investors who want a better view of the investment landscape.

What impact can private investment have in Africa?

Cohen: Africa, particularly from American and development agency vantage points, has historically been seen as a place for aid. The mindset shift from “aid” to “marketplace” over the past decade or so is an important trend and it supports sustainable economic development. Ensuring that private markets are able to function efficiently is necessary to have structural, sustainable change that allows for innovation and market growth. Otherwise, typically when aid programs run out there needs to be another aid program. Instead, Prosper Africa can bring in private capital to build a power plant or a manufacturing facility in East Africa that could employ thousands of people at higher salaries than before. Or it can support an entrepreneur’s new venture that will change the way food or financial services are distributed across the continent. This is what leads to lasting change, and Asoko is excited to play a part in that story.

Read more interviews and stories featuring investors and business leaders in the Prosper Africa Blog.