This is the final blog of a three part series. Read part one here. Read part two here.

While on an official visit to South Africa in August, U.S. Secretary of State Antony Blinken laid out a new, bold strategy for engagement between the United States and Sub-Saharan Africa. The Secretary stated: “The United States and African nations can’t achieve any of our shared priorities, whether that’s recovering from the pandemic, creating broad-based economic opportunity, addressing the climate crisis, expanding energy access, revitalizing democracies, strengthening the free and open international order – we can’t do any of that if we don’t work together as equal partners.”

Through our work at Prosper Africa, the U.S. Government continues to make these joint efforts a reality.

Increasing two-way trade and investment has always been our mandate, as we bring together the full suite of U.S. Government services and resourcing to empower businesses and investors with market insights, deal support, financing, and more.

Since launching Prosper Africa in 2019, the U.S. Government has helped close over 800 two-way trade and investment deals across 45 African countries.

Central to this mandate are the delegations of major investors that we bring from the U.S. to countries across the African continent, shifting their risk perceptions and introducing them to tailored investment opportunities.

Recent deal successes

Through some of our recent delegation efforts, several U.S. pension funds – including the Chicago Teachers Pension Fund, the City of Philadelphia Board of Pensions and Retirement, and the City of Hartford Pension Commission – have worked alongside similar funds in Kenya and South Africa to invest $85 million in equity in Development Partners International (DPI), a majority women-owned and managed private equity fund.

Seen as a catalyst to inclusive and green growth, private equity is a vital component of Africa’s economic development, with the African Development Bank already using such funds to invest in a diverse range of African enterprises to support their expansion.

We are already seeing similar exciting new developments through the DPI deal, as they have used a significant portion of the investment to fund small and medium sized enterprises throughout West Africa. Recently, DPI announced it was acquiring a $64 million stake in Groupe Cofina, a financial services business based in Côte d’Ivoire which is driving financial inclusion by bridging the financing gap for entrepreneurs and small businesses across nine countries in West Africa.

With a $350 billion gap in access to finance across the continent, more organizations are looking for new, innovative solutions to close it. Cofina’s strategy has been structured around assisting young entrepreneurs establish a proven track record, building their capabilities to access additional funding.

“Groupe Cofina’s impact really stood out from the beginning,” DPI partner Babacar Ka said. “That impact is huge. We’re seeing the changes that this financing can have in African economies.”

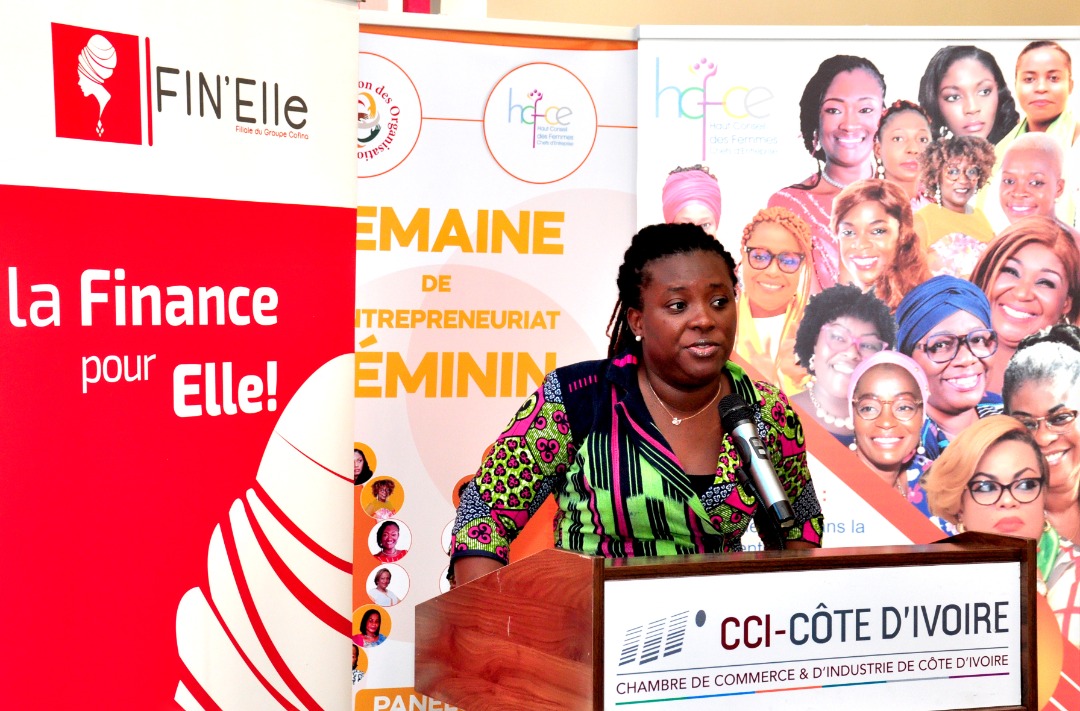

One of the fastest growing companies in Groupe Cofina’s portfolio is Fin’Elle, an Ivorian company whose name roughly translates to “Finance For Her.” Fin’Elle’s work has already seen great success in lending to women entrepreneurs and has inspired a financing model that is being replicated in Senegal.

Cofina is also fostering innovation in agriculture – a market expected to top $1 trillion in Africa by 2030. Another of Cofina’s Senegalese partners, which harvests oil from baobab trees – used in cooking, haircare, and skincare – has become the second largest baobab oil exporter in the country.

An equal partnership

Through our delegations across Kenya, South Africa, Senegal, Morocco, and beyond, I have spoken with U.S. investors whose perceptions around Africa have been transformed. What’s perhaps most exciting is their realization that through collaboration, we can maximize economic opportunities in both African countries and the United States.

We’re directing the attention of U.S. investors to the untapped market opportunities across Africa, and they’re recognizing the energy, engagement, and dynamism across our shared trade and investment ecosystem

The U.S. Government sees this as an opportunity to create enduring partnerships between U.S. and African financial sectors, creating shared prosperity. Engaging U.S. investors was a major feature at the U.S.-Africa Leaders Summit. During the U.S.-Africa Business Forum, U.S. and African businesses and investors announced new commitments aimed at increasing economic engagement between U.S. and African businesses, governments, and investors.

To view the highlights from the U.S.-Africa Leaders Summit, visit https://www.state.gov/africasummit/

By Cameron Khosrowshahi, Senior Investment Advisor, Prosper Africa